Hi, my name is Jérôme Vasamillet, based in Switzerland. I started this blog with the conviction that Health is our most valuable asset. Through this blog, I share insights and relevant solutions to help individuals on how to nurture their Wealth 💸 and Health 💚 assets all-in-one along their life journey.

My career spans across Fintech startups & scaleups, Private Banking and setting up a Digital Health accelerator for a leading health insurance company in Switzerland. This experience showed me that there are many useful parallels between Healthcare and Wealth Management, yet there is no existing connection between the two. I’m therefore on a journey to connect Wealth and Health!

WHealth is the concept of considering your Health as your most valuable asset. I explain here the approach to helping individuals grow their wealth and enhance their health through what I named WHealth Care.

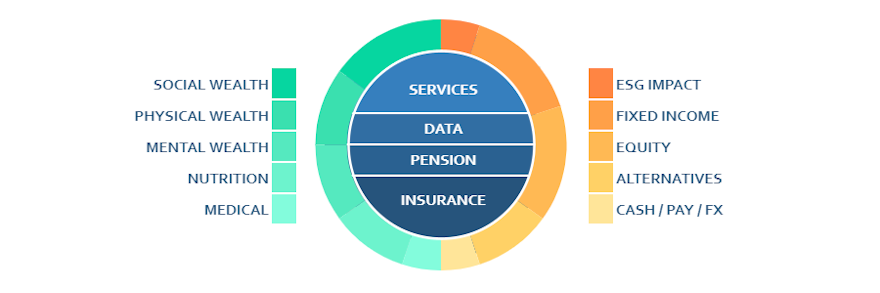

Over the next blog posts, we’ll explore how this is represented by a new approach to managing your time and money through the WHealth Portfolio depicted hereafter:

The WHealth Portfolio combines time and money allocation for enhanced Healthcare and Wealth Management, leveraging Fintech and Digital Health solutions. It also helps you build the right preventive and positive impact habits.

On one hand, Wealth Management and Fintech tend to focus on preserving or growing our financial assets but lacks true consideration for positive social and environmental impact. On the other hand, Healthcare and Digital Health tend to focus on cure and treatment versus prevention, diagnosis and recovery.

WHealth Care combines and augments the two by integrating our health as an asset that needs a focus on prevention and an overall approach for positive health / social / environment impact. It is constructed around WHealth Journeys which consist in building habits and using impactful solutions with a long-term approach for facing the ups and downs throughout our life journey.

An asset being a valuable item that is owned, it’s natural to consider our health as our most valuable asset. We own it, our life depends on it, and it requires care. As an asset, its value can increase or decrease: while some reasons are out of our control, others are — such as building healthy habits and focusing on prevention / monitoring / rehabilitation. In addition, it is important to link health with wealth, considering that higher levels of financial wealth can support activities and services enhancing our health. Conversely, better health can enable us to generate more financial wealth.

The objective of WHealth Care is dual: firstly to help individuals manage both through a unified approach (benefiting from best practices in each) and secondly, to provide the most relevant, personalized service for individuals to allocate their time and money.

Well-being is relative because it is usually the change from a previous state that leads to being aware of one’s well-being. It is also subjective because individuals place more, less, or no importance on health over wealth. People with various levels of health and wealth can live equally happy lives as others. However, a key question to ask yourself as early as possible is

“Will I enjoy my wealth if I don’t have health?”

Through WHealth Care, allow yourself to access the relevant knowledge, solutions and habit-building tips. WHealthify is the platform giving you access to a curated selection of cost & time efficient solutions to help you Get WHealthy, try it now: join us as a Beta user!

Please do follow and share this with your family, friends and colleagues!

Get WHealthy, Jérôme

P.S. some food for thought…

Which Wealth Management best practices are useful for managing your health?

Here are a few examples I’ll be integrating in future blog posts:

- Diversification

- Suitability

- Risk Profile, Investment Horizon and Expected Returns

- Portfolio review and rebalancing

- Investing vs. Speculating

- (Social or Monetary) Return on Investment

- Compounding

Which Health Care best practices are useful for managing your wealth?

Here are a few examples I’ll be integrating in future blog posts:

- Annual checkup covering your health history, physical exam and tests

- Make connections with nature and talk to people

- Take care of your work-life balance

- Protect yourself and monitor chronic diseases

- Move, sleep, exercise, take breaks from digital

- Eat well with a healthy diverse diet

- It’s never too late to change your (bad) habits